What is a Secondary Suite?

A Guide for Investors and Homeowners

Introduction

Secondary suites, also known as Secondary Dwelling Units (SDUs), are self-contained living spaces located within the main structure of a home. These units have their own kitchen, bathroom, and living space, making them completely independent from the primary residence.

With the introduction of Bill 23, secondary suites have become a go-to strategy for Ontario real estate investors looking to create rental supply, boost their property value, and generate cashflowing assets. The legislation allows up to two additional suites per residential property, with some/most municipalities allowing two secondary suites within the main dwelling. This flexibility has created a significant opportunity to address housing affordability and meet increasing rental demand in Ontario’s major cities.

Whether you’re a real estate investor or a homeowner exploring opportunities to enter the market, secondary suites can help you achieve your goals. Let’s take a closer look at what they are, how they differ from other housing units, and how government programs can help make them a reality.

Secondary Dwelling Units (SDUs) vs. Accessory Dwelling Units (ADUs): What’s the Difference?

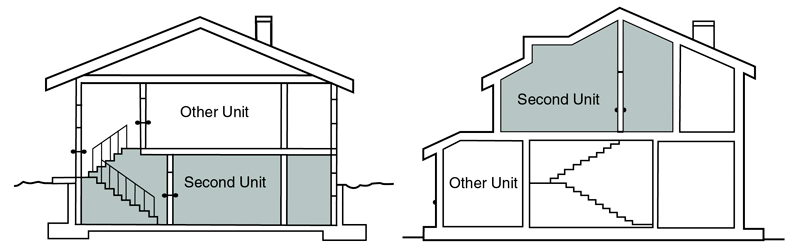

A secondary suite, or SDU, is a self-contained unit located entirely within the main dwelling. This includes spaces like basement apartments, finished attics, or building additions containing a unit. Secondary suites are not stand-alone structures; they’re integrated into the existing footprint of the property, making them cost-effective and easier to construct than detached units.

In contrast, Accessory Dwelling Units (ADUs) are detached structures that are separate from the main home. Examples include garden suites, laneway houses, and converted detached garages or barns. The primary distinction is structural: SDUs are inside the main house, while ADUs are separate buildings designed to complement the primary residence.

For example, a finished basement apartment is a secondary suite, while a garden suite/laneway house built behind the main property is an ADU. If you’re interested in building your own Garden Suite / Laneway Home, check out our article “Choosing The Right Garden Suite.”

What Types of Projects Count as Secondary Suites?

A secondary suite is a self-contained unit within the main dwelling, commonly found as:

Basement apartments – Independent living spaces with private entrances, kitchens, and bathrooms.

Finished attics – Converted upper-level spaces designed as separate units.

Home additions – Expansions to the main house that create self-contained living spaces.

Recent policy changes have made it easier for homeowners and investors to add up to two secondary suites per property, increasing rental supply and investment potential. Additionally, many municipalities have removed development charges for these units, reducing costs for property owners.

Since zoning rules vary by city, it’s essential to work with trusted professionals to navigate regulations and design a functional, compliant suite. ZA Suites is available to answer questions and help you get started.

The Canadian Secondary Suite Loan Program

iStockphoto/Castle City Creative

Unlocking Opportunities for Homeowners

For homeowners and first-time buyers, the Canadian Secondary Suite Loan Program is a game changer. Introduced as part of the 2024 Fall Economic Statement, this program doubles the loan limit to $80,000 to help cover the costs of creating secondary suites.

The program offers low-interest loans with 15-year terms at just 2% interest, making it more affordable to convert a basement into a rental apartment or transform a garage into a living space. Applications for the program open in early 2025, providing a much-needed boost to homeowners looking to contribute to Canada’s rental housing supply.

Learn more and apply here: Canadian Secondary Suite Loan Program.

Additional Financing Options

Starting January 15, 2025, homeowners can also refinance their mortgages with insured loans to cover up to 90% of their home’s post-renovation value, up to $2 million. This allows for flexible financing options that can be combined with the loan program to make secondary suites more accessible than ever.

Why This Matters for Investors and Homeowners

For real estate investors, the loan program reduces upfront construction costs while increasing rental income and property value. For homeowners, it offers a chance to “house hack” by renting out a secondary suite to offset mortgage payments, making homeownership more affordable.

What’s Next?

At ZA Suites, we help homeowners and investors unlock the full potential of their properties. Whether you're looking to create a secondary suite for rental income, offset mortgage costs, or take advantage of government programs like the Canadian Secondary Suite Loan Program, we’re here to guide you every step of the way.

Our team specializes in navigating zoning regulations, designing efficient layouts, and ensuring your project meets local bylaws. We also help clients maximize financial opportunities by assisting with grant and loan applications, making it easier to secure funding and reduce construction costs.

With Bill 23 and the Canadian Secondary Suite Loan Program, there has never been a better time to invest in secondary suites. If you're ready to explore your options, reach out to ZA Suites today. Together, we’ll transform your property into a smart, high-value investment.

Let’s build something great—contact ZA Suites now to get started!